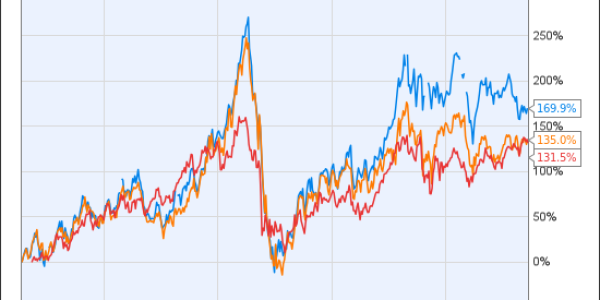

BY CARLA FRIED JUNE 21, 2013 1 0 When it comes to commodities, gold and energy typically bubble up as the go-to ways to add some alternative asset class diversification to a portfolio. Thing is, you’re typically in for a feast or famine experience, depending on global demand (for oil) and the global zeitgeist (for gold). From the Lehman Brothers bankruptcy in September 2008 through the debt-ceiling debacle in August 2008 the price of gold nearly doubled. Since then, as the Chicken Little trade has lost its appeal amid mending economies, the price of gold is off nearly 25%. With energy, you’re pretty much beholden to the direction of oil prices , which swing around in line with the global economic outlook. Here’s how the Vanguard Energy ETF’s ( VDE ) price chart side by side with the direction of oil prices. Brent Crude Oil Spot Price data by YCharts If you’re intrigued by the idea of adding a commodity sleeve to your portfolio, timber is an often overlooked commodity worth consideration. First off, it’s a renewable resource. Can’t say that about gold or (most) energy. It’s also got a flexible harvesting schedule. You can’t keep corn in the ground if prices soften. A benchmark timber index had an annualized gain of more than 12% from 1987 through 2012, compared to the S&P 500 ’s annual gain of just below 10%. Coming out of the market low in March 2009, the SPDR Gold Share ETF ( GLD ) hasn’t been half as productive an alternative investment as the two largest timber ETFs, Guggenheim Timber ( CUT ), and iShares S&P Global Timber and Forestry ( WOOD ). WOOD data by YCharts Then there’s the Grantham seal of approval to consider. Jeremy Grantham, co-founder of GMO, which manages more than $100 billion for institutional clients, has been an eerily canny long-term seer. He was harping about the tech excess in the 1990s long before bubble talk became fashionable. He was also out in front on suggesting we had a bit of a credit/debt imbalance prior to the 2008 meltdown. The GMO team has long been pounding the table on the diversification and inflation-hedge attributes of timber for years. In GMO’s latest seven-year forecast, the 5.9% projected real return for timber is equaled only by the firm’s outlook for much more volatile emerging market stocks. For perspective, GMO expects run of the mill U.S. small and large caps to register negative returns over the next seven years when adjusted for inflation. High quality U.S. large caps — think excellent ROE and low debt — are expected to fare better, with an annualized 3.7% real return. But that’s still two percentage points less than timber. If you’re looking to rotate out of some profitable investments that look a little long in the tooth these days, timber might be worth a look as a long-term hedge position. To be sure, GMO and other big time institutional clients can invest directly in timber. With timber-focused ETFs you’re of course buying a portfolios of businesses that traffic in timber, in whole or part. For a more direct stake, you can take a look at Real Estate Investment Trusts that own forestland. Weyerhaeuser ( WY ), which converted from a mish-mosh of paper-related business to a full on REIT in 2010, is a major holding in both ETF portfolios. The company just announced it will pay $2.65 billion to buy more land that will increase its Pacific Northwest timber acreage by 33% to more than 6 million acres. (Pacific timber has a faster route to Asian emerging markets than southern timberland.) At the same time, Weyerhaeuser says it’s considering a sale or spinoff of a home-building subsidiary. The net takeaway: it’s doubling down on direct timber ownership and looking to cash out of a main consumer of said timber. Granted a forward PE ratio north of 20 isn’t exactly a bargain, but that’s well below Weyerhaeuser’s recent highs. Management announced it plans to finance the deal by issuing more equity and debt. As a little company research shows, Weyerhaeuser’s debt-to-equity ratio is below 1.00; that makes it far more stable than Plum Creek Timber ( PCL ), but it’s still more leveraged than the other major U.S. timber REIT, Rayonier ( RYN ), which operates in the Southern states. WY Debt to Equity Ratio data by YCharts As with all REITs, at least 90% of income must be distributed to investors. Weyerhaeuser’s current dividend yield is 2.8%. Rayonier’s dividend yield is at 3.3%. Carla Fried, a senior contributing editor at ycharts.com, has covered investing for more than 25 years. Her work appears in The New York Times, Bloomberg.com and Money Magazine. She can be reached at editor@ycharts.com. You can also request a demonstration of YCharts Platinum. – See more at: http://ycharts.com/a…h.wJduGa6w.dpuf Taylor Scott International

Time For Timber? 25-Year Gain Crushes S&P 500

This entry was posted in Investment, investments, News, Property, Real Estate, Shows, Taylor Scott International, TSI, Uk and tagged asian, carla, crushes, fried, investment, investments, javascript, property, real estate, shows, timber, typically. Bookmark the permalink.