Taylor Scott International News

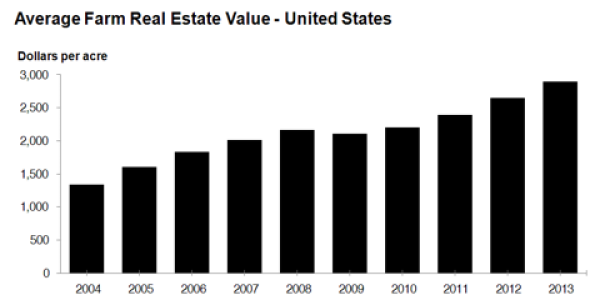

Sep 23 2013 Buying farmland isn’t what it used to be. As stated by British born investor Jeremy Grantham in a re cent Wall Street Journal Article : “The investment implications are, of course, own stock in the ground, own great resources, reserves of phosphorous, potash, oil, copper, tin, zinc-you name it…and the most important of all is food. The pressures on food are worse than anything else, and therefore, what is the solution? Very good farming, which can be done. The emphasis from an investor’s point of view is on very good farmland” Increasing urbanization has changed the view on farmland in regards to investing and inflation protection. This disconnect hasn’t stopped many institutional and large investors, like Grantham, from seeing value in the “nooks and crannies” and adding high quality farmland to their portfolio’s. Arable land demand has increased substantially in the last decade as attested by record farmland values. The U.S. average price of farmland increased nearly 9% in 2011 and nearly 10% in 2012. (click to enlarge) (source: NASS ) On a global level, China’s Xinjiang Production and Construction Corps recently purchased 7.4 million acres of farmland in Ukraine . Indonesia also announced they were looking to buy 1 million hectares (roughly 2.47 million acres) of Austrialian farmland for cattle production. The growing number of countries purchasing farmland capacity seems to point to future concerns of food supply. As the Dow Jones Industrial and the S&P continue to touch record highs, investors may want to begin looking at alternative investments that have low to negative correlations to the “traditional” asset classes. You can invest in farmland and agriculture in a variety of ways. Below are few ways to play continued returns in farmland. Gladstone Land Corp ( LAND ) – A U.S. based farmland investment company that currently offers a plus 9% annual distribution. It owns and leases farmland in Florida, California, Michigan and Oregon with appraised land value of $79 million. The distribution is paid monthly which should attract income investors. MarketVectors Agribusiness Index ( MOO ) – A diversified agriculture ETF with holdings in a variety of the largest agribusiness companies globally. Holdings include Bunge ( BG ), Archer Daniel Midland ( AMD ), PotashCorp ( POT ) and Deere ( DE ). Cresud ( CRESY ) – An Argentinean based agriculture company that currently owns roughly 2.4 million acres of farmland in Argentina, Brazil, Paraguay and Bolivia. CRESY produces a variety of crops consisting of soybeans, corn, and sugarcane. It also has operations in beef cattle and milk production. In the second quarter , Cresud sold 4 of its farms for roughly $60.5 million and saw large gains in its farmland development business. CRESY is currently trading down roughly 60% from its highs back in late 2010. Many farming companies have struggled to release value for shareholders with the drop in crop prices but now many are beginning to see value with the sale of farmland. Adecoagro SA ( AGRO ) – Adecoagro is a Luxemburg based small-cap agriculture company. AGRO operates on roughly 300,000 hectares of land throughout Brazil, Argentina and Uruguay and produces a variety crops including sugar, corn, soybeans, cotton, rice and dairy. Since peaking in March 2011 at $13.91 a share, Adecoagro is currently trading near its lows at $7.45. I like AGRO for many reasons, but primarily due to it currently trading at a discount to the value of its land given recent sales. Along with its variety of crops, Adecoagro is also a large producer of ethanol in Brazil which has stabilized revenues to a certain degree in recent quarters as energy prices have remained high. As referenced earlier, some large investors have been heavily investing in agriculture with the value of farmland in fertile areas increasing substantially. AGRO is no different. Currently Soros Fund Management has a $200 million stake (roughly 21.3% ownership) in the company, making AGRO the one of the largest small-cap positions the fund has. Capitalizing on the value of its land in the fourth quarter of 2012, AGRO sold a portion (51%) of its stake in the Santa Regina Farm located in Brazil for $13 million (around $7,000 per hectare). AGRO purchased the entire property for $2.3 million ($625 per hectare) in 2002 and is expected to sell its entire portion of the land for a combined $26.1 since the buyer exercised its option to purchase the remaining 49% for $13.1 million in July. When calculating the cost of improvements that AGRO put into Santa Regina, the company disclosed they realized an internal rate of return around 34%. In terms of earnings, AGRO recorded adjusted EBITDA of $41.3 million for Q2 2013 up 39.3% from same period 2012. The total 6 month 2013 EBITDA is also up 123.2% to $70.5 million. As indicated by its Q2 press release, despite low agricultural prices AGRO has increased margins by 12.3% in 2013. This is a very good sign moving forward. Despite the fact that 70% of its 2013 earnings are expected to come from sugar and sugar based products (ethanol), the value of the land and the growing demand for its food products is hard for an investor to pass up. Farmland has long been considered to be the ultimate safe haven investment and now appears to be a good time to own a piece of the “farm”. Commodity Portfolio I currently own AGRO, ADM and SCPZF.PK for farmland exposure. My current commodity portfolio holdings and percentages are below. As I had mentioned in previous articles , I am expecting inflation to tick up as we enter into 2014. In response, I have been transitioning into an overweight commodity portfolio. Over the last year I have been taking profits as the market as climbed back from lows in 2009. I recently took profits in a few positions including Microsoft ( MSFT ), The Sherwin-Williams Company ( SHW ), Omega Healthcare Investors ( OHI ) and Wells Fargo ( WFC ). From my perspective, the economic outlook doesn’t support continued investment in those companies. A softening U.S economy and high debt levels will push investors into safe havens and real assets. Going forward I will be looking to add investments on my watchlist and trim other positions. It will be interesting to see how an overweight commodity portfolio will perform relative to the rest of the market. Taylor Scott International

Taylor Scott International, Taylor Scott